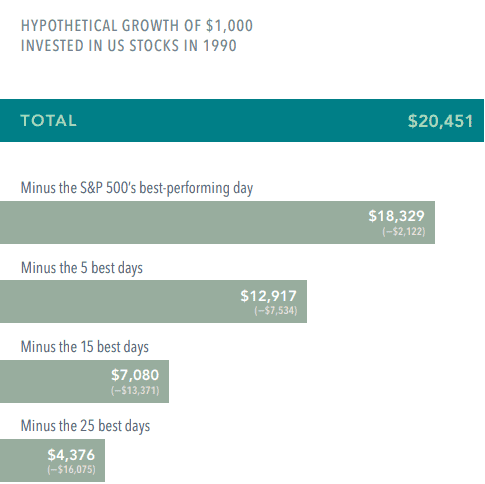

The impact of missing just a few of the market’s best days can be profound. We have a pretty cool data visualization of a hypothetical investment in the stocks that make up the S&P 500 Index that illustrates the dangers of trying to time the market.

Learn more about how we manage your investments!

Key Takeaways

📌 Market Timing Pitfall: Trying to predict market movements and adjust your asset allocation based on short-term trends can be detrimental to your long-term financial growth.

📌 The Impact of Missing the Best Days: Even missing just a few of the best-performing days in the market can have a significant impact on your investment returns over the long run.

📌 Data Insights: Looking at a hypothetical $1,000 investment in the S&P 500 from 1990 to 2020, missing the 25 best days resulted in missing out on over $1.6 million in growth for a $100,000 investment.

📌 Emotional Decision-Making: It’s important to separate emotions from investment decisions. Markets go through ups and downs, but historically, they have recovered and continued to grow.

📌 Focus on the Long Term: Rather than trying to time the market, it’s more effective to stay invested for the long term and maintain a diversified portfolio aligned with your financial goals.

Video Transcript

MIKE

All right. Good afternoon! This is Mike and Jennifer with Summit Financial Partners, doing another Facebook Live event today. Today, we are talking about market timing, or I guess the cost of trying to time the investments in the market. And this topic has come up, we typically will get this question from time to time and recently with such a strong bull market that we’ve had in the in the last several months, people start to get a little bit uneasy and start to think:

“Maybe we should think about timing the market and pulling our asset allocation back,”

“Something may be happening in the near future, just because it’s been so positive, it can’t go like this forever.”

“Something’s going to happen, and we don’t we don’t want to be a part of the downturn.”

“Should we draw back our asset allocation? Should we be a little bit more defensive?”

That’s an understandable thought if you are kind of thinking that “I want to time the market.” And I’d say everybody’s guilty of it, advisors just the same. You know, we want to think that something’s probably going to happen soon, but there’s some really detrimental costs to taking that kind of approach, and we wanted to talk about that supported by some data and some real hopefully logical arguments behind that instead of the emotional side in trying to time that.

JENNIFER

Yeah. People do make most of their decisions emotionally, not logically, so we’ll hopefully provide some of that logical framework around it. So, a couple of things to think about as we approach this topic. One is there’s really no top to the market. The markets are very high especially us markets, and we’re just part of the world. There’s lots of other markets out there. And so, there is no top. There’s no point at which it cannot grow anymore. That is not to say the ride up will be smooth. We know it won’t, that’s just the way it works. And it’s actually quite normal to have a correction of about 10 percent every year. So, it’s not unusual. It seems to be a little less unnerving to people lately when that happens, but we haven’t had one, like a normal 10% correction in a while. Now a year and a half ago almost, we had a pretty severe correction, or really it was not even a correction. It was just the bottom fell out because of the worldwide shutdown of economies due to Covid, the spread of Covid. Some of these market pullbacks are more severe and some more severe than others. And some, you have an obvious reason like Covid or the financial crisis of 2008 when many people had borrowed more than they could pay back, and there were some big things going on with the insurers, and Lehman Brothers went bankrupt. I still call it the Lehman Aggregate Bond Index and it hasn’t been that for a long time. Sometimes the reasons are more subtle and sometimes it seems to be no reason at all. It just could be computer trading, or some fears grip the market, people get worried about presidential elections, lots of different things that can happen. And so, the range of corrections is quite wide and the reasons behind them are quite varied but the main thing to remember is, it’s rare for any correction to not have been recovered and grown beyond within a year. It’s unusual for a recovery to take — up to three years is the longest one really in recent history, which was in the 80’s actually. So, we do understand your concerns about the market, and we know our world’s still dealing with the aftereffects of Covid and there’s so much turmoil going on in our country and other countries and it makes us all uncomfortable, no matter what side of any issue you’re on. It’s uncomfortable, and people are worried. So, it’s definitely a valid concern, but the data will tell you…

LOOKING AT THE DATA

MIKE

So, one of the one of the charts that we wanted to pull up so that you could see is this chart on the cost of trying to time the market and in that philosophy or that thought exactly that we were just describing there. Just to show the data that we’re working with here is the hypothetical $1000 of investment that you invest into the S&P 500 at the beginning of 1990, and you leave there all the way to the end of 2020. So, December 31st of 2020. So, it’s a 31-year period that we’re investing this $1000 into S&P. Now, you can see with the top bar graph there that your thousand dollars would have grown to $20,451. As we kind of go down the chart, you start to see the impact of trying to time the market. And what’s really impactful here is when we’re talking about timing the market and what people are actually doing, they’re taking money out of equities, out of stock, for an extended period of time.

JENNIFER

Right. Because they think it’s going to go down.

MIKE

Right. So, what this second bar chart is showing is actually missing one day. Now, it is the best performing day in that 31-year period but just to show that when that best day actually happens in any kind of time period, that’s a gambling game.

JENNIFER

Yes.

MIKE

And we actually went through before today’s video to look at some of those top performing days and when they were, and even still looking back, we’re trying to put logic behind why one day was so great. Sometimes, it’s right after a dip and sometimes it’s right before a dip.

JENNIFER

Yep.

MIKE

Like when those actually happen, there was really no predictable evidence, even looking back now, that we could say “oh yeah, well that’s why that day is so great.” So, as you can see from that first bar chart there, that $1000 would have grown to $18,329. So, you missed out on over $2000 of growth by missing one single day in that 31-year period. And as we go down, it just gets more extreme. I’ll just point out, the bottom one is missing the 25 best days in that 31-year period, your $1000, instead of growing to over $20,000, would only be worth $4376.

JENNIFER

Less than a day per year.

MIKE

Right. I did the calculations. That’s 25 days out of 7,843 market days in that 31-year period. So, your money is invested for 99.7% of the time.

JENNIFER

And you still… wow.

MIKE

And that’s the kind of amount you’re missing.

JENNIFER

And most people aren’t investing just $1000, right?

MIKE

Yeah. So, to kind of put that into I guess more realistic numbers there, it’s not uncommon for somebody to have $100,000 invested or more. But if we say $100,000 and we take that $100,00 and invested it, I’m really just adding zeros to the numbers here, and we had to double check ourselves when we first did this because it seemed crazy, but if you invested $100,000 in 1990 and missed the best 25 days, you would have missed out on $1.6 million of growth.

JENNIFER

Now that is a much more meaningful number. That’s painful.

MIKE

That’s nuts. Saying that your money’s worth $4,000 instead of $20,000, you know, that’s the cost of a cheap car, but when we’re talking $100,000 invested, you’re missing out on 1.6 million dollars of growth by missing 25 days. It’s just 25 days. So that’s the potential cost of trying to time the market. When we say detrimental, I mean, that’s beyond detrimental.

JENNIFER

Oh, it’s life changing. Life-changing, for sure. And bear in mind what huge events happened in that 31-year period. We had the Asian contagion and the long-term capital management implosion, which blew up the markets in 1998. We had the dot-com crash in 2000. We had the terrorist attack in ’01. We had the financial crisis of ’08. We had the U.S. Down grade of debt in 2011, and we had what just happened in 2020 with the Covid shutdown. And those are just the big ones. There’s lots of less of lesser magnitude ones that have happened. So, this fear and concerns we have about what’s going on in our world today, there really isn’t a time in our world where we don’t have some big issues going on, unfortunately. So, just kind of bear that in mind. And I think too one thing that is not always in the forefront of people’s minds when they’re attempting to time the market and say, “I’m getting out of stocks, at least a little,” is that you have to be right twice. You have to know when to sell. Let’s say you sold at the top. Then it’s like, when do you get back in? And we still to this day have talked to people who got out the bottom of the market in 2008 and never got back in. And they’ve missed this huge bull market and over decades, they’ve lost life-changing amounts of money by not getting back in. And so as painful as the corrections can be, you’re better off just kind of maybe not opening your statements for a few months or logging in for a little bit.

ACTION STEPS

We do want to talk about a couple things of real actions that can be taken. First of all, if you have a life circumstance that requires an asset allocation change, a change in equity allocation, that is a different issue than fear.

MIKE

Yeah.

JENNIFER

So, that is something definitely to consider. Occasionally, we have clients that do that. There’s a very good reason why we would change their mix of equity to bonds.

MIKE

But it’s never market related. It’s always certain life circumstances.

JENNIFER

Yes. And I so vividly remember many conversations when that conversation has happened while the markets are down, and we’re like, “absolutely but let’s wait a little while till the markets are recovered,” and then we go ahead and switch it. So, if someone were to come in here today wanting to draw back their equity allocation for life circumstance reasons, we’d be like, “this a good time, the markets are up for sure.” So, it’s not a blind following but it’s also not timing. Its life circumstance timing. So, the other thing to do, sort of like mini timing, is rebalancing. Rebalancing is, in our portfolios anyway, we have a set target that we want to hold of stocks versus bonds, and within each of those portions of the portfolio, how much in each fund or kind of fund that we want to have. How much do we have the U.S.? How much do you want to have internationally? How much in the small companies versus large companies? And if you have a very specific target, you can see when things get out of balance. So, what happened, this is an extreme example of it, but in March and April of last year it was really about the third week of March in 2020 when the markets were down, we said “oh, we need to rebalance, and we need to sell bonds and we need to buy stocks.” Because even though the markets are down 40%, that’s as bad as it got in the ‘08 crisis which was huge, and it might go down some more and it might take a year and a half to recover but right now we can buy stocks on sale. So, we didn’t sell everything, but we brought everybody back to their target and bought into the equity markets then. It’s a little bit of a contrarian move, and people don’t like it at times because they’re like, “What are you doing? You’re buying into a down market!” But it does pay off. You stay within that set philosophy and that set asset allocation that you’ve already determined together with your clients, and it does help. Your long-term returns over time are better. So, I didn’t think the markets were going to recover as quickly as they did, so it was very exciting when they did, but we were ready for a long-haul recovery at that point. And still, our economies are not fully open, but the stock market hasn’t acted like you would expect because it is not predictable.

MIKE

Yeah and in that, in our periodic rebalancing and sticking to an asset allocation, after that March rebalancing where stocks are way lower than bonds which prompted us to buy stocks…

JENNIFER

Yeah. That was really fun.

MIKE

It was the opposite several months later when we go in. What was a couple of the funds that we were selling a ton of?

JENNIFER

Yes, like Targeted Value, which was an asset class that actually hadn’t been dripping along for a while, but it was medium to small companies that suddenly like just took off at the end of last year, and some of the international allocations. And so, then we ended up pairing back some to get it back.

MIKE

Right. Back to the bonds.

JENNIFER

Yep. You have to have a methodology to it all.

MIKE

Yeah so we have this video that we want to link to or share, we’ll figure out a way to get it out there, that is put out by Dimensional Funds, the fund family that we use. And he uses this cool illustration where he’s kind of just talking about timing the market. It’s like gambling. I saw another analogy in saying in trying to time the market is like saying standing at the roulette table and seeing that, well, the roulette ball has landed on red for the last you know 30 moves. You know, however many. They say, “Oh, black is due.” You know, people say, “Black is due.”

JENNIFER

But the odds are always the same.

MIKE

The odds are always the same. “Because it has landed on red so many times, it’s more likely that it’s going to land on black.” And that’s just not true.

JENNIFER

it seems logical. It does.

MIKE

Yeah. So, that’s the same thing that people are doing here. “it’s been positive for so long, we’re due for something to be negative.”

JENNIFER

Yep. The guy in the video is Ken French, and he’s a very famous researcher in the world of investments and their model is the Fama/French model. He’s a professor at Dartmouth, and I’d definitely recommend you listening to him. He’s good.

MIKE

Yeah. If you don’t believe us, listen to Ken.

JENNIFER

Yeah. Listen to Ken! Well, thank you for joining us. We hope that was helpful. We welcome your questions you can email us at info@summitrva.com. We’d also love any ideas of things that are on your mind that you would like us to talk about, and we’re open to pretty much any financial topic that is on your mind. So, please let us know.

MIKE

Yep. Thanks!

JENNIFER

Thanks! Bye!

Want to chat more? We’re always here!